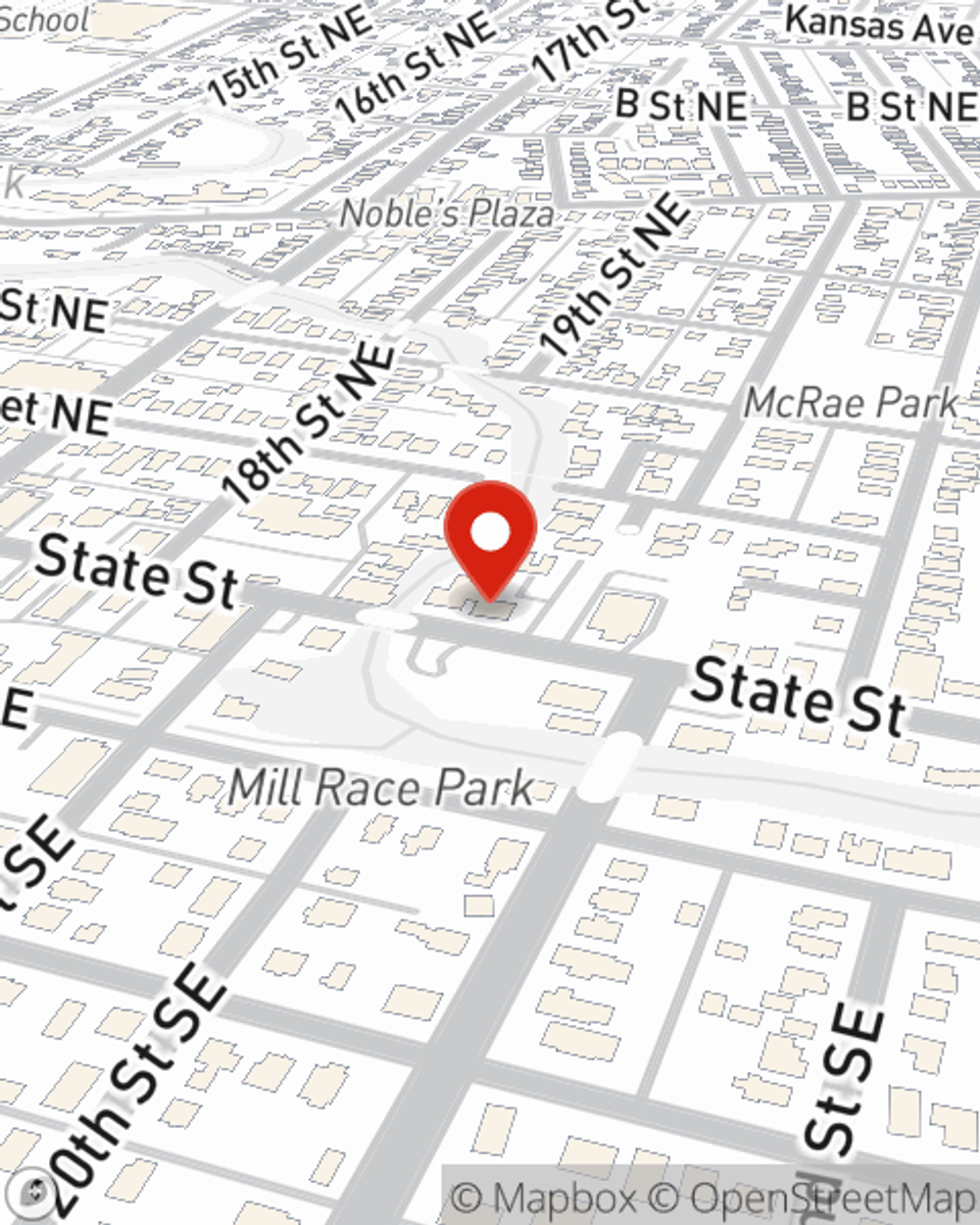

Life Insurance in and around Salem

Protection for those you care about

What are you waiting for?

Would you like to create a personalized life quote?

Be There For Your Loved Ones

The common cost of funerals in America is around $8,300, according a recent study by the National Funeral Directors Association. Unfortunately, it may be difficult for your family to manage that expense as they grieve. That's where Life insurance with State Farm comes in. Having the right coverage can help the people you love pay for burial costs and not fall into debt.

Protection for those you care about

What are you waiting for?

Love Well With Life Insurance

Some of your options with State Farm include coverage for a specific number of years or coverage for a specific time frame. But these options aren't the only reason to choose State Farm. Agent Alex Ferry's outstanding customer service is what makes Alex Ferry a great asset in helping you settle upon the right policy.

Interested in discovering what State Farm can do for you? Get in touch with agent Alex Ferry today to get to know your unique Life insurance options.

Have More Questions About Life Insurance?

Call Alex at (503) 370-7716 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

Simple Insights®

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®